The long-running legal saga of Terraform Labs co-founder Do Kwon, the man once hailed as a “crypto genius” and later vilified as the architect of one of the industry’s largest financial catastrophes, may finally be approaching its endgame.

Tomorrow morning, a U.S. federal court in New York will convene to determine whether Kwon will change his plea to guilty on fraud and market manipulation charges linked to the $40 billion implosion of TerraUSD (UST) and Luna.

If confirmed, this would mark a dramatic reversal from Kwon’s previous stance, and could lock in one of the most significant criminal convictions in crypto history after years of drama.

How Do Kwon Went From Crypto Prodigy to Global Fugitive

Do Hyeong “Do” Kwon rose to prominence as the charismatic face of now infamous Terraform Labs, pitching the algorithmic stablecoin TerraUSD (UST) as the future of decentralized finance.

UST’s peg to the U.S. dollar was maintained via an intertwined relationship with the governance token Luna, a mechanism Kwon touted as both elegant and fail-safe.

For a time, the market agreed. At its peak in early 2022, the Terra ecosystem boasted a market capitalization exceeding $50 billion, with Kwon positioned as one of the most influential figures in Web3.

But behind the public hype, U.S. prosecutors allege Kwon orchestrated a complex web of deception, including faked real-world adoption, manipulated market activity, and concealed control over supposedly decentralized protocols.

When UST’s dollar peg faltered in May 2022, the project entered a death spiral.

Luna’s price collapsed to near-zero, wiping out life savings for retail investors and billions from institutional portfolios.

DISCOVER: 20+ Next Crypto to Explode in 2025

The U.S. Department of Justice now claims Kwon’s response to the crisis was not to admit failure, but to double down on deception: arranging covert market interventions to prop up UST temporarily, disseminating misleading audit reports, and allegedly laundering hundreds of millions through shell entities and Swiss bank accounts.

By the time the dust settled, an estimated $40Bn in market value had been vaporized.

The fallout rippled far beyond Terra’s direct investors, triggering broader panic in the crypto sector and fueling a regulatory crackdown still shaping cautious crypto policy in environments likethe UK Today.

You Can Run But You Can’t Hide: Do Kwon’s Fugitive Years

(Source)

After the collapse, Kwon left South Korea and began a months-long odyssey evading international law enforcement.

His journey ended in March 2023, when he was arrested in Podgorica, Montenegro, attempting to board a flight with a fraudulent Costa Rican passport.

Even in custody, Kwon’s legal fate was contested. South Korea and the United States fought for extradition, with the case bouncing between Montenegrin courts for more than a year before Washington prevailed.

Kwon was formally handed over to the FBI in December 2024. He faces nine felony counts, including wire fraud, securities fraud, commodities fraud, market manipulation, and money laundering conspiracy.

If convicted on all counts, he faces a theoretical maximum of 130 years in prison – a true life sentence.

Will Tuesday Bring a Potential Plea Deal?

(Source)

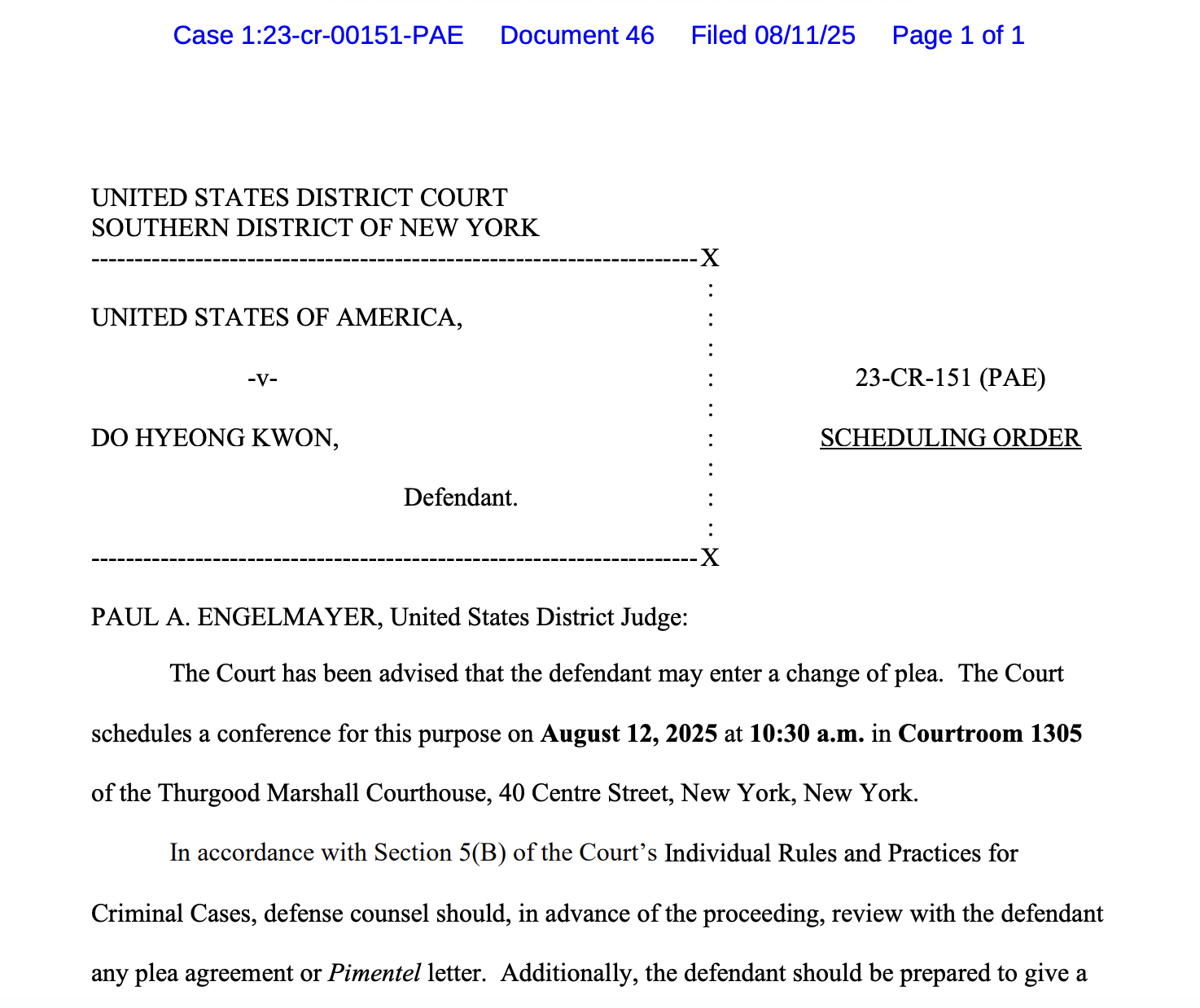

Now, less than a year after his extradition, Judge Paul Engelmayer of the U.S. District Court for the Southern District of New York has ordered a conference at which Kwon “may enter a change of plea.”

The judge has instructed defense counsel to prepare a full narrative allocation, meaning a detailed, on-the-record confession covering all elements of the crimes to which he pleads guilty.

A plea deal could spare Kwon a lengthy and unpredictable trial, but it would also require him to admit to one of the most high-profile fraud cases in finance history.

The specifics, including whether the agreement involves cooperation with prosecutors or a recommended sentencing range, remain sealed.

If Kwon pleads guilty, it could signal a turning point in how U.S. authorities prosecute crypto executives accused of large-scale fraud.

With Sam Bankman-Fried already serving time for the FTX collapse, two of the most infamous names in crypto could soon share the same legal fate.

Whether tomorrow’s hearing marks the conclusion of Kwon’s saga or just another twist in a years-long drama, one thing is clear: the man who once sold the world on a vision of decentralized money is now fighting for his freedom in the same courts he once dismissed as irrelevant to crypto. Stay tuned.

EXPLORE: Best Meme Coin ICOs to Invest in 2025

Join The 99Bitcoins News Discord Here For The Latest Market Updates

The post Do Kwon’s Last Stand: The Endgame of Crypto’s Most Expensive Cautionary Tale appeared first on 99Bitcoins.

No Comment! Be the first one.