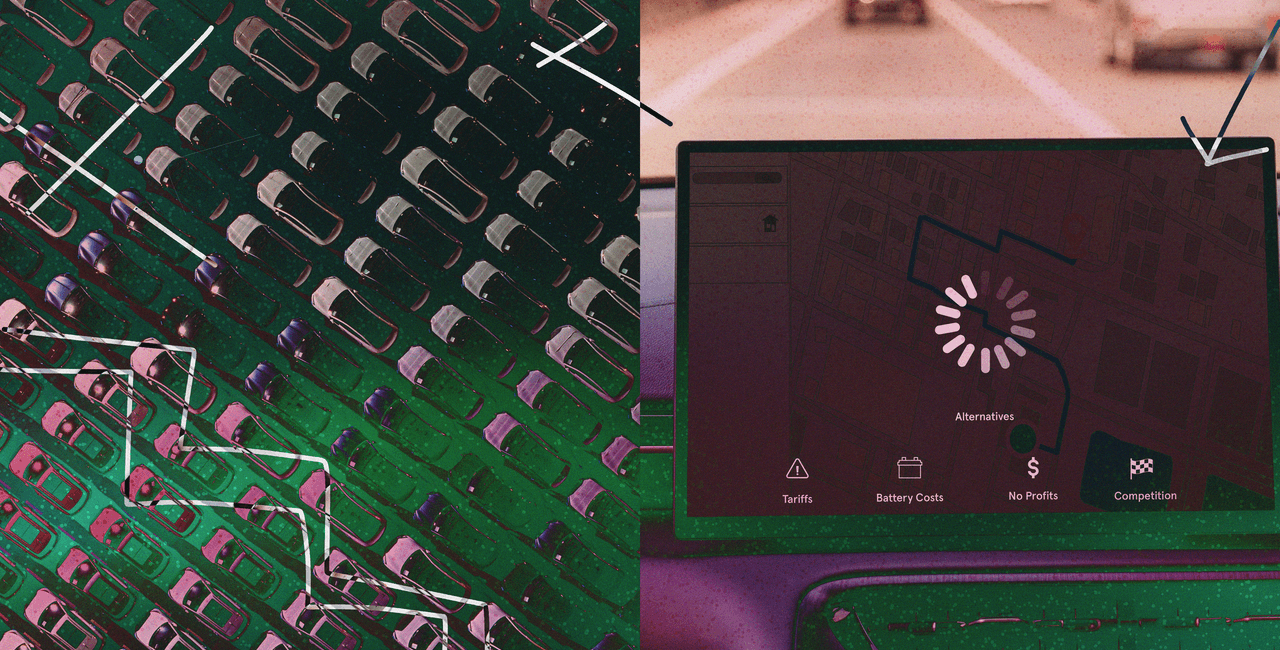

Houchois describes Tesla as a reluctant carmaker, forced to spend industrial levels of capital updating a physical product from which software levels of margin are always tantalizingly out of reach. “Musk doesn’t want to play the BYD game,” Houchois says. “He thinks the BYD game is last year’s game. Except until you have tomorrow’s business generating cash, you need to play in last year’s game.”

Data Driven Shift

All carmakers are still working very hard on creating the fully upgradeable vehicle. “For me the software-defined car is really the game changer,” Xavier Martinet, head of Hyundai in Europe, tells WIRED. “If everything is mechanical, if you want to go from manual air conditioning to automatic air conditioning, you cannot. If it becomes a software issue, you can actually sell it.”

Carmakers however, while well-versed in selling physical options like leather seats or sunroofs, have yet to prove they can do the same with digital upgrades.

Most now understand from early experiments in selling subscription access to preinstalled technology such as heated seats, or accepted freebies such as Apple CarPlay, appear greedy and can alienate customers. According to a survey from S&P Global customers increasingly don’t like such subscriptions, with proportions of those saying they would pay for connected services dropping from 86 percent in 2024 to 68 percent in 2025.

Undeterred, VW has just introduced a monthly subscription to increase the power of some of its electric cars, a move that mirrors Mercedes’ Acceleration Increase for its EQ models, which initially cost $1,200 a year.

Perhaps more crucially, automakers have been so entranced by the mere possibility of selling software in cars, few have been able to nail down precisely what in the future they’ll sell that consumers will deem genuinely worth buying.

Yet despite setback after setback, car companies are clinging to the dream that when this as yet largely unidentified genuinely useful new technology arrives, they can be the ones to monetize it, rather than losing out to more nimble tech companies or other suppliers.

Forced to raise their game, carmakers are only now realizing they cannot repeat past mistakes such as letting others build up parts and services businesses off the back of their core product. “They stole the business from us,” Martinet says, referencing as an example windscreen replacement companies. “So I don’t want them to steal the next one.”

Hyundai is staying in the subscription sales business—a more flexible form of leasing. “Sometimes you’re losing money as a whole, but you’re recovering a business that has been lost to leasing companies, to banks, to insurers,” he says.

One car company that refreshingly seems to have more than just a rough outline of a plan for the next decade is Ford. Farley believes business customers are an excellent source of income for subscription revenue. “The customer who uses their vehicle for business looks at their vehicle completely differently than a retail customer,” Farley told WIRED. “When it’s not working they lose revenue, unlike retail customers, who are just annoyed. So they pay for productivity software.” Ford claims it now has almost one million subscriptions for its ‘Pro’ software.

No Comment! Be the first one.